Math Finance Seminar Series

Spring 2025 Math Finance Seminar

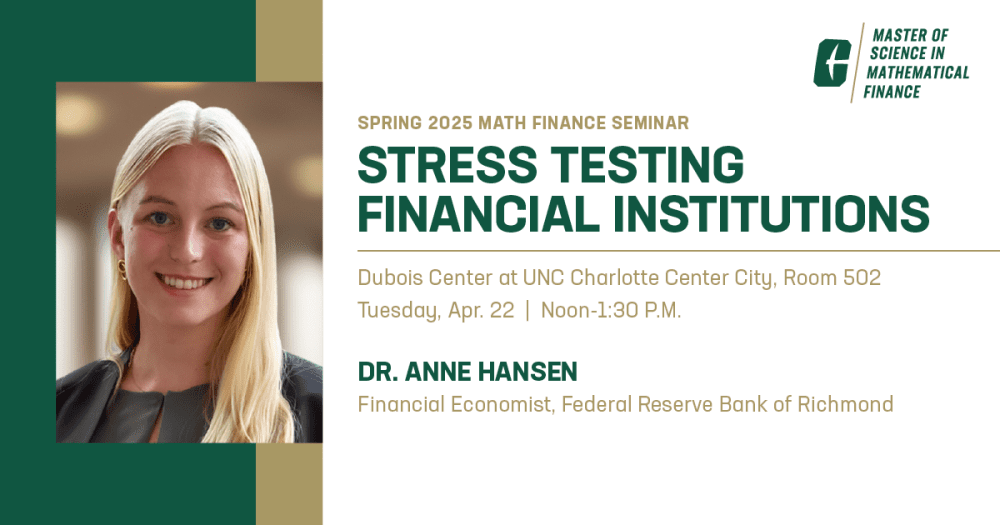

Join us for the Fall 2024 Math Finance seminar featuring Dr. Anne Hansen, Financial Economist at the Federal Reserve Bank of Richmond. She will discuss will discuss how the Federal Reserve uses stress testing to promote a safe and sound banking system. She will focus mainly on the design of hypothetical scenarios for stress testing the trading books of financial institutions.

The presentation begins at noon, followed by a Q&A. This is an in-person, brown-bag lunch seminar, so please feel free to bring your lunch. Beverages are provided. The event will not be recorded.

previous Math Finance seminars

A Rational Multi-Asset Portfolio Rebalancing Decision-Making Framework

Speakers: Yu Zhang, senior investment strategist, and Harshdeep Ahluwalia, head of asset allocation, Americas, both from The Vanguard Group.

Empirical Applications of Valuation and Risk Management Models

Speaker: Michael Pagano, The Robert J. and Mary Ellen Darretta Endowed Chair in Finance at Villanova University

Strategic Bank Liability Structure Under Regulatory Capital Requirements

Guest Speaker: Dr. Zhenyu Wang, Professor of Business Finance and Edward E. Edwards Professor at the Kelley School of Business at Indiana University, and former head of Financial Intermediation Function at the Federal Reserve Bank of New York

Recent Developments in Reinforcement Learning and Its Application in Finance

Guest Speaker: Renren Dong, Director, Senior Trader at Bank of America

The Dawn of Decentralized Finance and MAFI Alumni Career Panel

Guest Speaker: Dr. Steven Clark, Associate Professor of Finance

Panelists:

- Danielle Avery, AVP, Sr. Data Technology Analyst, Bank of America

- Jacob Etringer, Quantitative Analytics Co-Op Associate, Wells Fargo

- Katrina Hartley, AMD Engineer, Goldman Sachs

- Peter Trzil, Risk Analytics Sr. Specialist, Charles Schwab

2020 Belk College Outstanding Young Alumna presentation

Guest Speaker: Jane Wu ’07, M.S. in Mathematical Finance, recipient of the 2020 Belk College Outstanding Young Alumna Award and President of Panorama Holdings, LLC.

SBIG Data: Big Impact on Predictability

Guest Speaker: Dr. Guofu Zhou, Frederick Bierman and James E. Spears Professor of Finance at Olin Business School (OBS)

Standard Initial Margin Model: A Practitioner’s Perspective

Guest Speaker: Jonathan Wu, Managing Director Area Head of Corporate Market Risk Oversight of Rates, Wells Fargo Bank

Two Sides of the Same Coin: Why Corporate Risk Managers and Trading Risk Managers Calculate Risk Differently

Guest Speaker: Dr. Paul Romanelli, Head of Corporate Risk Model Development (CRMD), Wells Fargo Bank

A Simple and Robust Approach for ES Estimation in Risk Management

Guest Speaker: Dr. Tao Pang, Associate Professor & Director of Financial Mathematics Program, Department of Mathematics, North Carolina State University

Theoretical Problems in Credit Portfolio Modeling

Guest Speaker: Professor David X. Li, Professor of Finance, Faculty Co-director of Master of Finance at Shanghai Advanced Institute of Finance (SAIF), Associate Director of Chinese Academy of Financial Research (CAFR) at Shanghai Jiaotong University

Market Risk Stress Testing: Concepts and Issues

Guest Speaker: Dr. Keith A. Heyen, Managing Director, Market Risk Analytics Credit & Market Risk Management, Wells Fargo

Archive

Machine Learning for Financial Modeling; Agus Sudjianto, Executive Vice President Head of Model Risk at Wells Fargo

What is Fintech? Dr. Yimin Yang, Senior Director at Protiviti, Inc.

Risk-Adjusted Pricing for Bank Loans Under Market Interest Rate; Dr. Yimin Yang, Senior Director at Protiviti, Inc.

-

Resume Book and Career Development for M.S. Mathematical Finance Students; Robin Boswell, Director of Graduate Student Career Development

Financial Planning and Management Reporting – Establishing Financial Plans and Measuring Progress; Patrick Sullivan, Director Corporate Financial Planning & Analysis (CFP & A)

Global Association of Risk Professionals (GARP); Dr. Lisa Ponti, Vice President – Institutional Outreach The America, Global Association of Risk Professionals (GARP)

Financial and Economic Analysis for Investing in Renewable Energy and Energy Markets; David March, Co-Founder and Managing Partner of Entropy Investment Management

Term Auction Facility: The Fed’s First Response to the Financial Crisis and Its Effects on Labor; Dr. Zhenyu Wang

Advances in Fair Lending Modeling; Dr. Maia Berkane, Wells Fargo

Counterparty Credit Risk: Measurement and Management; Catherine Li, SVP, Bank of America

-

Model Risk Management in the Current Environment; Tony Yang, Director in Financial Risk Management, KPMG LLP, Advisory Service